We must recover the cost of serving customers, or we could not stay in business. At the same time, we intentionally make no profit. Revenue requirements are defined in our budget process and by our bond debt. The budget proceeds independently from rate-setting, while at the same time keeping frugality of expenditures in mind. The Board and Staff strive to keep rates low.

This is all driven by our mission: To provide our customers superior water, wastewater and water reuse services at reasonable costs and in an efficient manner, today and in the future. We have a rigorous cost of service rate design procedure to accurately generate the required revenue to carry out our mission. Water and wastewater expenses and revenue are kept separate, and one does not subsidize the other.

The object of the rate design is to determine utility and ad valorem tax rates required to cover the cost of service, which is the sum of operations and maintenance (O&M) expenses, including minor capital expenditures/special projects and debt service obligations. We cover water debt service in the water rates, and through wastewater debt service and some O&M through ad valorem taxes.

The O&M budget accounts for about 53% of the cost of service. The Debt Service requirement for water and wastewater facilities accounts for the balance of the cost of service (47%). The Debt Service is the actual amortization cost of outstanding bonds determined at the time of the bond issue.

Water

Our water (and wastewater) rates consist of two components: the base charge and the volume charge. It is appropriate that a sizeable fraction of the required revenue be in the base rate so even low-volume users share in the capital cost of the facilities.

To encourage water conservation and collect more revenue from larger water users, we raise more revenue from the water volume charge than from the base charge. We also weight volume rates in a multitiered schedule increase; this encourages conservation. We allow the base charge to float as required to generate our required revenue. The ratio of base to volume charge is 42:58, generating more revenue from volume than base rates. The volume rate weighting brings the base rate down even with rates covering debt service rather than taxes.

Most water systems have their customers pay for capital facilities in property taxes. Some also cover a portion of O&M in taxes. Lakeway has about three-quarters of its customers In-District (ID) and one-quarter Out-of-District (OD). All water-related capital debt service is in the water rate. You pay no taxes for water or water facilities. This debt service is in the water rates and allows us to have the same rates In-District (which we can tax) and Out-of-District (which we cannot tax). About 41% of the base and volume rate is debt service for which you pay no taxes. The base rate does not even cover the debt service for water facilities.

Wastewater

The volume factor for the wastewater rate design employs a methodology generally referred to as winter averaging—in other words, a billing period is selected when water usage is at a minimum; a bimonthly average is calculated and that volume (annualized) becomes the volume billing factor. The average bimonthly volume used by each customer during that period determines the customer’s bimonthly volume for the entire year.

For wastewater, we have taxes that generate the amount required to retire debt incurred to construct wastewater facilities. Thus, the monthly base and volume rate must generate the funds to cover only O&M.

Currently, the M&O tax is 3 cents to allow us to clean the entire collection system to avoid wastewater backups. By the Board’s choice, this M&O tax revenue is dedicated to wastewater infiltration and inflow (I&I) control projects, but it could be used for any District purpose. The rest of the property tax is used solely for debt service payments.

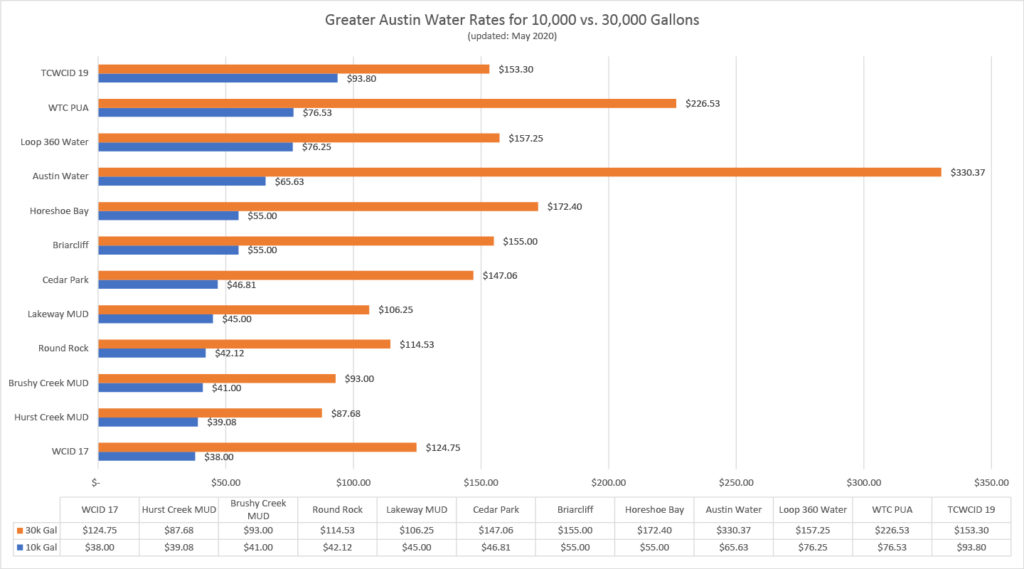

While some customers may feel our rates are high, they are based on our cost of doing business in providing superior water, wastewater and reuse services in this area. Some may claim that our water users subsidize our wastewater customers. This is absolutely not true. While some may claim the rates are unfair to the extreme low-volume user, they could be considered equally unfair to our extreme high-volume user. We believe rates are just and fair and consistent with conservation goals. Our rates are among the lowest in the area. Our cost of service rate design employs the Texas Commission on Environmental Quality’s (TCEQ) approved methodology, which incorporates principles advocated by the National Association of Regulatory Utility Commissions. Our cost-of-service design methodology was approved after review by order of the TCEQ in early 1988.

You are now being redirected to the WaterSmart page.

You are now being redirected to the WaterSmart page.