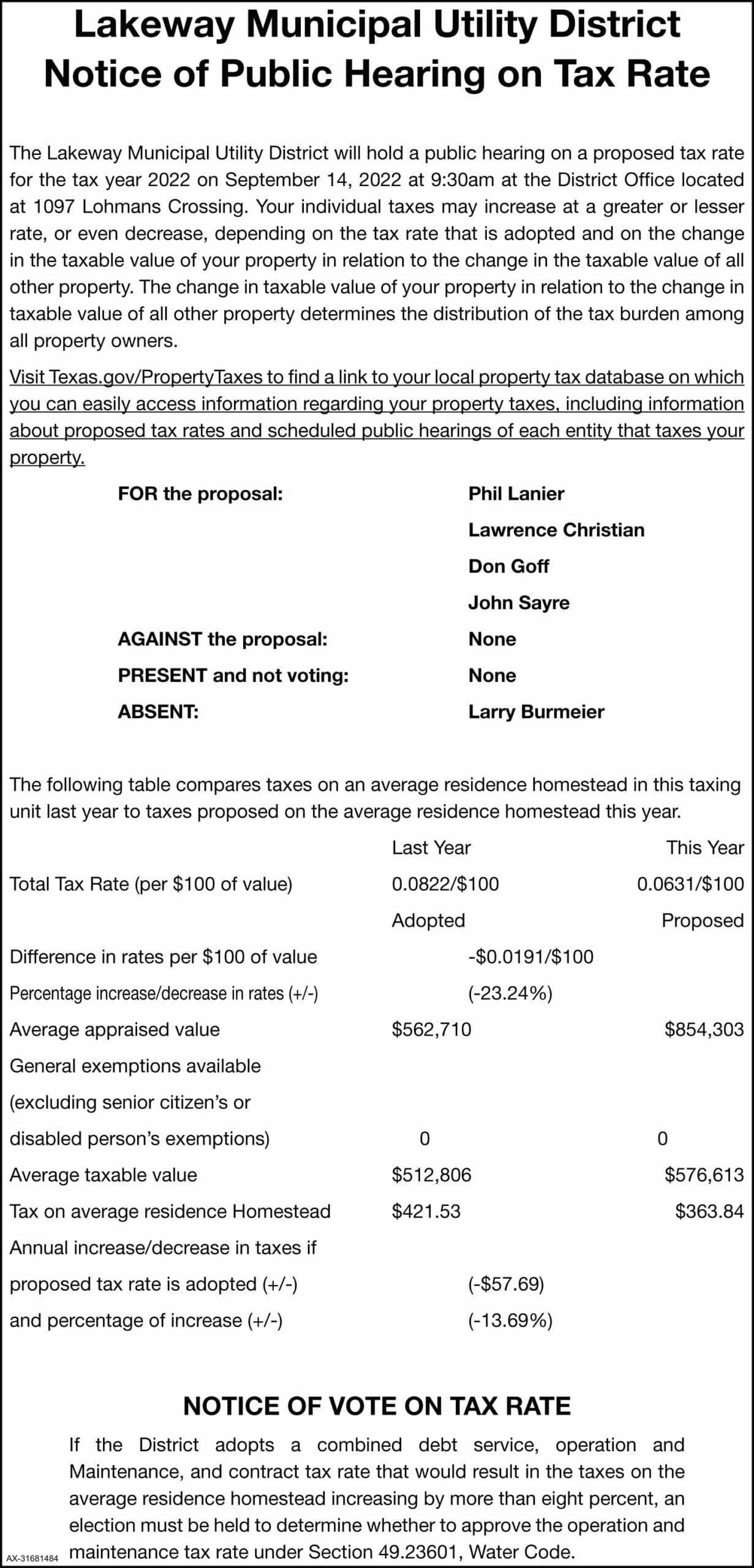

Notice of Public Hearing on Tax Rate

The Lakeway Municipal Utility District will hold a public hearing on a proposed tax rate for the tax year 2022 on September 14, 2022 at 9:30am at the District Office located at 1097 Lohmans Crossing. Your individual taxes may increase at a greater or lesser rate, or even decrease, depending on the tax rate that is adopted and on the change in the taxable value of your property in relation to the change in the taxable value of all other property. The change in taxable value of your property in relation to the change in taxable value of all other property determines the distribution of the tax burden among all property owners.

Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information about proposed tax rates and scheduled public hearings of each entity that taxes your property.

| FOR the proposal: | Phil Lanier |

| Lawrence Christian | |

| Don Goff | |

| John Sayre | |

| AGAINST the proposal: | None |

| PRESENT and not voting: | None |

| ABSENT: | Larry Burmeier |

The following table compares taxes on an average residence homestead in this taxing unit last year to taxes proposed on the average residence homestead this year.

Last Year |

This Year |

|

| Total Tax Rate (per $100 of value) | 0.0822/$100 | 0.0631/$100 |

| Adopted | Proposed | |

| Difference in rates per $100 of value | -$0.0191/$100 | |

| Percentage increase/decrease in rates (+/-) | (-23.24%) | |

| Average appraised value | $562,710 | $854,303 |

| General exemptions available (excluding senior citizen’s or disabled person’s exemptions) | 0 | 0 |

| Average taxable value | $512,806 | $576,613 |

| Tax on average residence Homestead | $421.53 | $363.84 |

| Annual increase/decrease in taxes if | ||

| proposed tax rate is adopted (+/-) | (-$57.69) | |

| and percentage of increase (+/-) | (-13.69%) | |

NOTICE OF VOTE ON TAX RATE

If the District adopts a combined debt service, operation and Maintenance, and contract tax rate that would result in the taxes on the average residence homestead increasing by more than eight percent, an election must be held to determine whether to approve the operation and maintenance tax rate under Section 49.23601, Water Code.

As published in Lake Travis View, weeks of 8/15 and 8/22, 2022.

You are now being redirected to the WaterSmart page.

You are now being redirected to the WaterSmart page.